Portals: A Treatise on Internet-Distributed Television

Skip other details (including permanent urls, DOI, citation information): This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 3.0 License. Please contact [email protected] to use this work in a way not covered by the license.

For more information, read Michigan Publishing's access and usage policy.

3 Strategies of Internet-Distributed Television: Vertical Integration and the Studio Portal

Although it featured distinctive affordances from its outset, internet-distributed television did not appear overnight. Significant shifts from long-held norms in the competitive practices of broadcast-, cable-, and satellite-delivered television developed as internet use was introduced to American homes and just before the arrival of internet-distributed television. These adjustments in revenue models and competitive strategies in what we might now distinguish as the “legacy” industry—those television industry entities that existed before internet distribution—must be acknowledged to properly identify changes that preceded internet-distributed television from those it has wrought.

The US industry increased its reliance on subscriber funding and vertical integration in the years immediately before the launch of internet-distributed television, practices that then become even more central. It is certainly the case that the nonlinear affordances of internet distribution substantially disrupt established norms through the different protocols nonlinearity allows, but a simple story of cause and effect is made more complicated upon realization that two of the most notable adjustments are not particular to internet distribution at all.

The previous chapter explored the consequences of subscriber funding. Here, the focus shifts to vertical integration. Obviously not a new phenomenon, the stakes of vertical integration nevertheless have augmented implications as the television industry incorporates a new mechanism of distribution. Many of the portals are owned by companies that also own most—or all—of the content distributed through the portal. I categorize those portals whose primary reason of being is to leverage an existing library of content as “studio portals.” The strategic benefits of vertical integration also explain the shift to conglomeration and practices of media industries that date to the film industry’s ownership of theaters, but it requires new attention now because of the defining role it looks to play in establishing the competitive field of internet-distributed television. Even at the incipient moment of 2016, it appears that ownership of substantial intellectual property has already become a necessity for launching a portal. Such a barrier to entry ensures that the competitive dynamic of internet-distributed television will differ little from that of linear-based industries.

Shifts in Funding and Competitive Strategies before Internet-Distributed Television

Despite a tendency to speak of the US television industry as a single, coherent entity, this “industry” has long been composed of many different industries and businesses. Multiple, distinctive sectors compose the US television industry although they have become increasingly intertwined. For much of its “network era,” most sectors were distribution businesses that constructed a schedule of programming that was distributed by broadcast signal and later also by cable wire and satellite transmission.[1]

The broadcast sector alone contains multiple distinctive businesses: the broadcast network business—based on licensing content likely to attract a mass audience that is sold to advertisers; and the station ownership business, which is based on constructing a schedule of programming for a local station and selling the viewers collected by the programs to local advertisers. Most of these stations are affiliates of the networks, a business relationship that has changed considerably over the last thirty years from one of the networks compensating the stations to be affiliates, to the stations now offering payment to the network. The station and network businesses are in principle distinct although also complicatedly intertwined because of overlapping ownership whereby the networks own several of the largest and most lucrative stations (as many as they are permitted by regulation).

Similarly, the businesses of cable service providers (as well as satellite and other wire delivery companies) sell a service to subscribers enabling access to a package of channels. This cable provider business is largely separate from that of cable channels, which, like broadcast networks, license content to construct a schedule that attracts an audience the channel then sells to advertisers. Here too, some joint ownership among cable providers and cable channels exists, but the more considerable joint ownership can be found among broadcast networks and cable channels. See Table 2 for a breakdown of these separate yet related businesses.

| Broadcast |

| Network business (distribution; revenue from selling audiences to advertisers) |

| Station business (distribution; revenue from selling local audience to advertisers) |

| Cable |

| Cable/satellite service (distribution; sell a service to subscribers) |

| Cable channels (distribution; revenue from selling audiences to advertisers and fees from cable/satellite services) |

| Studios (production; make and sell content and manage intellectual property) |

Separate from all these television business sectors based on distribution is the business of the studios that make content and sell or license it to distributors such as networks, channels, and most recently, portals. An arrangement known in the industry as “deficit financing” served as the dominant financing practice for creating scripted programming for much of the network era, particularly after the 1971 enactment of the Financial Interest and Syndication Rules (Fin Syn) that required networks to purchase nearly all programming from studios not owned by the network.[2] To balance the considerable risk of content creation, the networks arranged to merely license programs rather than own them outright. They paid studios roughly 70 percent of production costs, and the studios funded the deficit and maintained ownership of the series. Successful series could be sold in secondary markets, such as to local stations and international buyers, which is where the most substantial revenues of content production were earned in the network era. Cable eventually emerged as another buyer, and most recently, so too have portals such as Netflix, Amazon Video, and Hulu.

Following the elimination of the Fin Syn rules in the mid-1990s, this arrangement subtly shifted as the networks, and then cable channels, vertically integrated production and distribution by having a conglomerate-owned studio produce nearly all the programs found on their schedules. Practices became more difficult to assess once contained entirely within a single corporation. From the 1990s through early 2000s, commonly owned studios and networks mostly operated as distinct divisions of conglomerates such as Disney, Viacom, and News Corp., and performance of the studio business was evaluated independently from the network. This enabled a continuation of previous norms so that studios and networks largely operated separately despite the increased efficiency their common ownership enabled. Over time, these entities became more intertwined—although often still maintained separate “studio” and “network” executive corps.

By way of illustration, the elimination of the Fin Syn rules allowed for NBC Studios to become the predominant source of programming aired on the NBC Network although by accounting measures, the NBC Network still paid NBC Studios roughly 70 percent of a show’s production costs to license a show, and NBC Studios, which financed the 30 percent deficit, then counted the revenue earned by selling the series in secondary markets on its divisional balance sheet. Licensing series from conglomerate-owned studios better ensured the pursuit of like-interest between the studio and network although they remained as separately evaluated entities within their conglomerate structure.[3]

Although never governed by Fin Syn, cable channels replicated the earlier broadcast practice when they began producing scripted series in the early 2000s. Many purchased their first original scripted series from externally owned studios because original cable series were viewed as very risky and lacking significant secondary market value to an extent that executives at commonly owned studios viewed them as too risky.[4] As these programs succeeded, the cable channels followed the dominant broadcast practice and created their own studios—the first in the early 2000s, but many around 2010—to produce the shows cable channels scheduled. For example, after Lionsgate, the studio that produced Mad Men, reaped the windfall of its licensing revenue and then Sony did likewise with Breaking Bad, AMC created AMC Studios in 2010 to produce subsequent series in order to maintain a financial interest in revenue earned in secondary markets. Expansion of vertical integration at this time was also evident as these conglomerates owning US cable channels purchased or established channels in international markets to expand economies of scale.

So then, the common ownership of production and distribution entities allowed by the elimination of the Fin Syn rules and the outcome of a wave of mergers and acquisitions in the early 1990s prepared a strategic pivot of industrial practice and strategy that was initiated before competition from internet-distributed television forced further change. Although vertical integration has commonly been understood as a competitive strategy, it also suggested the core revenue model of legacy television industries was shifting away from the historic reliance on advertising. Television production and distribution remained profitable as separate businesses, but the elimination of the Fin Syn rules and the conglomerated ownership structures that emerged throughout the 1990s enabled a diversification of revenue that decreased dependence on advertising and made intellectual property important to the network and channel businesses as well.

At the same time that reliance on intellectual property diversified revenue and adjusted strategies of the US television industry, networks and channels further modified revenue streams by expanding their reliance on subscriber funding. Most cable channels derived half their revenue from fees paid by cable service providers on a monthly per household basis that subsidized revenue received from advertising. This subscriber revenue increased during the 1990s and 2000s to become the dominant revenue stream for many cable channels. For example, FX president John Landgraf noted that when he began at FX in 2004, 55 percent of the channel’s revenue came from advertising, but by 2015, advertising accounted for just 34 percent of revenue and was diminishing by a percent a year.[5] Although many continued to think of cable channels as primarily advertiser supported, this shift in dominant revenue source left the channels more accurately described as subscriber supported and advertising subsidized. More than just an economic adjustment, this shift was important for explaining changes in programming strategies during the early 2000s.[6]

This decreasing reliance on advertising was not limited to cable, but broadcasters also adopted cable’s dual-revenue stream by 2010. Broadcasters began receiving an equivalent of subscriber revenue from cable providers in 2006 in the form of retransmission fees.[7] By 2010, the business model of the networks and station owners mirrored that of cable channels, and analyst Michael Nathanson notes 2014 as a “watershed moment” because revenue from cable and satellite providers overtook advertising dollars for the first time.[8] By 2015, retransmission fees accounted for $;6.3 billion dollars of broadcast network revenue.[9] This was valuable to the networks that received the full amount of the fees for their owned and operated stations and often half of the retransmission fees accrued by affiliate stations.

This interregnum period—after the period of Fin Syn rules and the conglomeration of once separate television businesses, yet before meaningful internet distribution—provides necessary background for considering adjustments in business practices related to the arrival internet-distributed television and the nonlinear distribution it allows. A series of structuring microeconomic adjustments redefined the business of the US television industry from the mid-1990s through 2010 that were largely separate from the substantial disruption that internet distribution of video introduced beginning by the end of that period. Such preliminary adjustments were responses to declining audience size as viewers spread across the expanding number of channels, as well as the financial crisis of 2008, all of which occurred just before internet-distributed competitors further fragmented audiences and posed alternatives to the dominant ad-supported system. Additionally, by this point the industry was twenty years and an executive generation removed from the Fin Syn rules and its related practices, which allowed its paradigm of separation between studios and networks to fade.

Importantly then, the television conglomerates diversified their television businesses to create three revenue streams: advertising revenue from selling the audience collected by the schedule of programming offered by networks and channels, retransmission/affiliate fees from cable/satellite/telco service providers in exchange for carriage of the network/channel on multichannel systems, and revenue from licensing studio-owned intellectual property in various traditional (syndication, off-net cable, international) and emerging secondary markets (internet-distributed program services, DVD, electronic sell-through, e.g., iTunes).

Vertical Integration in Internet-Distributed Television

Beyond the expanded use of subscriber funding, the other profound adjustment in industrial operations introduced by the affordances of internet-distributed portals was the capacity to reduce some of the layers of middlemen—or intermediaries in more academic terms—between those who make television and those who watch it. Despite the pre-internet distribution integration just chronicled, US television remained structured by a series of “bundles” that significantly inflated costs for consumers, adding as much as 100 percent to annual television ecosystem revenues according to an analysis by Needham and Associates.[10] As their analysis explains, the US broadcast and cable television industry featured bundles of bundles: individual shows are bundled into channels; channel owners such as Viacom, Disney, Time Warner, and Discovery sell bundles of channels to multichannel video programming distributors (MVPDs) such as Comcast or DirecTV; MVPDs bundle channels into tiers and sell access to viewers; and MVPDs bundle these video channels with internet access, home phone, and mobile phone service.

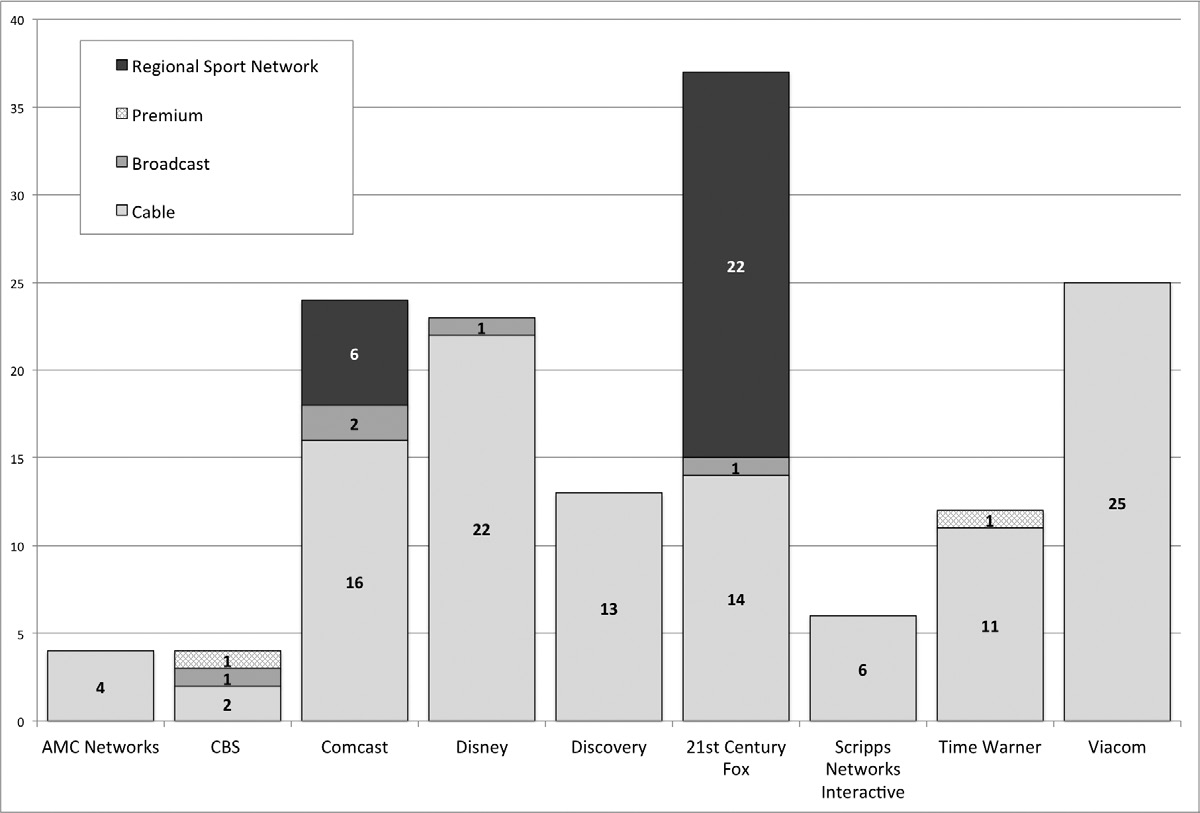

This reliance on bundling—particularly, the inability to separate content from channels and channels from cable packages—in combination with the lack of a competitive marketplace for internet or cable service in much of the country created a peculiar dynamic for US television distribution. Before the arrival of internet distribution, the most significant noncompetitive knot derived from the exceptional leverage content creators could exert upon MVPDs. With its hundreds of channels, it seemed the US television landscape was abundantly competitive, but analysis in 2013 revealed that nine companies (Disney, Fox, Time Warner, Comcast/NBCUniversal, CBS, Viacom, Discovery, Scripps, and AMC) controlled about 90 percent of professionally produced television content in the United States—illustrating the extent of the late 1990s conglomeration.[11] The result was that each of these content companies held the rights to some channel or content that it could use to leverage rich subscriber fees from MVPDs in a practice similar to the block booking film studios used in the 1930s and 1940s. For example, if a cable service wanted to carry “essential” content such as ESPN from Disney or Nickelodeon from Viacom, these content owners would require the systems to carry several other channels on the most widely available tiers (e.g., FreeForm, Disney Jr, Toon Disney, and Disney HD; or VH1, VH1 Classic, Spike, and Logo in the case of Viacom). It was this uncompetitive dynamic that allowed the increased reliance on subscriber fees even within an “advertiser-supported” television sector.

Chart 1, derived from a Variety report, illustrates how the nine companies that control professionally produced content distribute it through a multiplicity of commonly owned channels.[12]

The content oligopoly exerted unchecked power over MVPDs largely out of view of consumers who simply blamed providers for escalating fees. The arrival of satellite competition in the mid-1990s offered many viewers a competitive choice between cable or satellite service, but content owners forced everyone in the marketplace to provide the same value proposition—a large bundle of channels. Several cable channels began spending much more on original content in the late 1990s through early 2000s and required higher payments from MVPDs in affiliate fees in exchange. This, in combination with an explosion in the number of channels following the launch of digital cable systems in the late 1990s significantly increased viewers’ cable fees. Viewers grew frustrated with service providers, but the content oligopoly left providers little power in this situation. Content creators required higher fees and bundled packaging; MVPDs passed the costs content companies demanded onto consumers.

SOURCE: VARIETY, DRAWN FROM COMPANY REPORTS, SNL KAGAN, AND RBC CAPITAL MARKETS ESTIMATES.

EXCLUDES AMC NETWORKS’ INTEREST IN BBC AMERICA, CBS’ INTEREST IN POP AND THE CW, COMCAST’S INTERESTS IN FOUR CABLE CHANNELS AND TWO RSNS, TIME WARNER’S INTEREST IN THE CW, AND VIACOM’S INTEREST IN EPIX.

The relationship between MVPDs and consumers was a tinderbox ready for explosion when internet-distributed television arrived. Once net neutrality rules prevented content owners from paying for preferential distribution, a new distribution dynamic became possible. MVPDs, which had quietly morphed from cable service providers to internet service providers during the first decade of the twenty-first century, benefitted the most as they often were monopoly home internet service providers. The effects of viewers shifting away from video distributed by cable—so-called cord cutting or cord shaving—were limited for providers because such consumers could be pushed into higher- and highest-priced internet service tiers, and the profit margins on internet were much better for MVPDs than video because it had no programming costs. But viewers transitioning to internet-distributed television substantially affected cable channels. Every lost subscriber meant lower fees paid by MVPDs and a smaller audience base to sell to advertisers.

The emergence of internet-distributed television could have enabled significant adjustments in the television business—and initially seemed likely to—although by 2017 it appeared that the conglomerates that dominated broadcast and cable distribution would maintain their preeminence. Importantly, a few new players—particularly Netflix and Amazon—entered the industry. Netflix sneaked in by recognizing the opportunity of internet distribution while legacy entities were trying not to hasten disruption to broadcast and cable distribution businesses.[13] Amazon (as well as Netflix to an extent) was able to leverage revenue, brand recognition, and infrastructure from its online retail enterprise to also stake a claim. Of course, Hulu is often mentioned alongside these portals, but Hulu was simply a combined enterprise of the owners of NBC, Fox, and ABC and also differentiated by its reliance on advertiser support until its launch of a purely subscriber-funded service in 2015.

The other companies that own portals launched during 2015 and 2016 overwhelmingly own much, if not all, of the content distributed by the portal. The marketplace of internet-distributed portals is quickly becoming so robust—there were nearly one hundred by the end of 2015—as to make launching without a deep library of intellectual property nearly impossible.[14] Part of the barrier to entry that advantages studio portals results from newcomers’ lack of an existing library upon which the risk of new series can be balanced. Media economists explain a key strategy of the publishing model as what Miége terms the “dialectic of the hit and the catalogue.”[15] In other words, studios, labels, and other media that sell single goods in direct transactions have used a strategy of intentional overproduction in response to the uncertainty of audience tastes because having a diversity of offerings spreads risk. To date, internet-distributed portals have succeeded by curating a breadth of content—both new and acquired library content—that balances the inevitable failures of a high proportion of new content with established hits.

Of course, the development of studio portals has downsides for conglomerates. Following the elimination of the Fin Syn rules, conglomerates effectively bore the full costs and risk of production in integrating production and distribution—costs that broadcast and cable norms split between the studio (30 percent) and the networks or channel licensing the creation of the series (70 percent). Some attribute the exponential rise in series budgets in the early 2000s to vertical integration; executives reported that it became more difficult to stop spiraling production costs when producers argued that budget overruns were important for the long-term revenue possibilities for series once networks had a stake in them.[16]

The fact that vertical integration is becoming so deeply ingrained as a core strategy of portals is necessary to consider for a variety of reasons. For one, it indicates the likely continuity of key players of US television regardless of the disruption to practices that the affordances of internet-distributed television introduce. Although the pervasive popular and industrial discourse has been one of the “death of television,” it is difficult to find substantial casualties. Second, vertical integration emerges as a key curation strategy at a time when little is known about curation tactics. Other than tailoring libraries relative to niche dynamics, the other key explanation of what can be found in a portal’s library is that the portal owns the intellectual property.

The prevalence and entrenchment of vertical integration of content and distribution raises concerns given the history of media and its defiance of what Tim Wu describes as the value of a “Separations Principle” for the information economy to which these portals clearly belong.[17] Wu calls for a constitutional approach to the information economy that divides content and distribution companies. Admittedly, the key distribution companies—per Wu’s analysis—are the internet service providers. With the exception of Comcast, these companies do not also own stakes in content and are not yet participating in the launch of portals.[18] Nevertheless, it is important to consider the extent to which the concerns that led Wu to advocate for a Separations Principle extend to this context of vertical integration between portals and their intellectual property.

Finally, the effect of vertical integration upon creatives who make this content must be considered. The nature of producing content—the basic business practices involved in production—remains largely unchanged by shifts in distribution technology. But, as established, the strategies of intermediaries such as portals are different than those central to linear distribution technologies. Moreover, the adoption of a subscriber-funded revenue stream—used minimally in broadcast and cable distribution—introduces further change. At a technological level, internet distribution makes possible much more direct relationships between creatives and viewers. As the expansive realm of user-generated, internet-distributed video suggests, intermediary gatekeeping entities that have tremendous power in broadcast and cable distribution can be eliminated. Of course, the last decade has also made clear that intermediaries that help connect viewers to content of interest provide considerable value to both content makers and viewers.

At one level, the vertical integration emerging as characteristic of studio portals connects content makers more directly with audiences in a way that can reduce practices that commonly undermined creatives’ autonomy in broadcast- and cable-distributed television. Producing for a studio portal changes the business of production in a number of ways—mostly related to removing the middleman of the channel as scheduler—and affords entities that create content more control. In the network era of US commercial television, series were at the center of multiple, complicated exchanges, creating what economists describe as a dual-product market. Studios created series and first “sold”—although actually rented—them to networks and channels that followed the logics of flow industries and created schedules of programming that attracted audiences that they sold to advertisers. The first market buyer, the network, assessed the value of a show on the basis of its ability to attract the attention of advertiser-desired audiences within a linear schedule. Although this was a phenomenally lucrative exchange for decades, the arrangement is economically messy and inefficient compared with the strategies and practices enabled by nonlinear access and subscriber funding.

Producing original series for a subscriber-funded, studio portal allows those creating programming to transact directly with viewers—or at least with much less intermediation. Much of the arguable “efficiency” of studio portals derives from how they deviate from linear television norms to ensure a single master with a single interest. In the era of the Fin Syn rules, creatives received notes from the studio producing their series as well as from the network licensing the initial run, leading, at times, to contradictory and misaligned creative aspiration. The studio sought to nurture programs in ways that would make them more likely to have the extended production duration valued in syndication sales and other secondary markets, while the network focused on a show’s ability to attract an audience in its time slot. Sometimes, these priorities overlapped, but they also regularly diverged. Series produced for studio portals are meant for that portal’s library; priorities are not split between competing first and second market dynamics. Moreover, the subscriber-funding model allows emphasis on creating content viewers want without regard to how advertisers might also assess it.

One of the oft-repeated frustrations of studios and creators producing television series for the linear, schedule-defined television environment was their inability to control the time slot of a series; when a show was scheduled could be determinant of success regardless of its content. The success of shows also depended heavily on the extent of network promotion, another factor studios could not control.[19] Studio portals can still promote content differentially—although they have little motivation to deliberately disadvantage any content. The differential promotion of portals can also be far more strategic as comments by Sarandos in Chapter One suggest. In a linear context, differential promotion amounted to offering some programs better time slots and larger promotion budgets than others. In the case of portals, differentiation comes through the ability to target particular shows to particular audiences based on the data known about subscribers’ tastes. In practice, this is evident in the way Netflix pushes different shows to viewers in opening pages and recommendations.

Linear networks and channels determine when to continue or cancel series as part of the business of constructing a schedule and managing its inherent capacity constraints. The lack of such constraints for portal library curation largely eliminates the zero-sum situation networks and channels faced that could subordinate creative priorities to the demands of the schedule. Portals do not require content with specific length or a particular number of episodes per season.

In the most radical case to date illustrating the creative possibilities enabled by internet distribution, US comedian Louis C.K. self-funded, produced, and distributed the series Horace and Pete directly to audiences who paid a transaction fee per episode or for the season of episodes. Horace and Pete was produced without a “channel” or a “studio.” That an individual could produce and distribute television in this way tremendously changes the nature of television although this is likely an outlying case. Of course, Louis C.K. is not just any individual, and direct-to-consumer experiments—even by legacy studios—have not been embraced. At this point, it is important to acknowledge this technological possibility although many other industrial aspects may prevent it from ever being widely used.

From the perspective of the business interests of a media conglomerate, studio portals help maximize the value of intellectual property holdings by enabling a direct-to-consumer outlet that eliminates the stake external distributors receive, which is typically 20 to 40 percent of a retail transaction. In launching a studio portal such as CBS All Access, CBS bets that the cost of the portal is recouped in the difference between the revenue it will earn by self-distributing its content instead of licensing it to a portal such as Netflix.[20] Studios have been frustrated by the asymmetrical relationship in which the portals have extensive data about viewing behavior that allow them to far more accurately value content. Now that a substantial portion of the audience has been acculturated to the protocols of internet-distributed video, studio portals provide flexibility and control for intellectual property rights holders at a time of radical change in the business of television. Moreover, they afford the legacy rights holders the depth of viewing behavior data that their internet, upstart competitors have enjoyed.

What remains most uncertain is how well the skills, strategies, and experience of programming a channel will transfer to curating a portal for conglomerates that seek to build studio portals. The greatest uncertainty comes from the lack of knowledge about how building and maintaining a portal differs from deeply entrenched strategies for channels. Strategies related to timeliness and immediacy must be reconsidered and new metrics of success developed. Again, viewers’ expectations of content they pay for differ in ways that have meaningful implications for creative priorities.

To be clear, internet distribution via portals—studio or otherwise—does not eliminate the commercial imperatives that have challenged creatives, circumscribed experimentation, and encouraged the persistence of well-known formats and strategies in the television industry. The opportunity of studio portals extends many of the strategic pivots outlined at the beginning of the chapter that shifted the business of television before internet-distributed television emerged. It is too soon to make evidence-based claims about the consequences of studio portals for creativity. Although portals may diminish or eliminate practices that have frustrated creatives producing for broadcast and cable, they will likely create new practices that similarly challenge creatives. As in the case of the yet uncertain implications of subscriber-funded portals, coming critical analysis must understand the practical divergences of studio portals and weigh their limitations against their opportunities.

Timeliness, which so defined linear television, has not been a structuring imperative for many media, and it is the competitive strategies of such media that offer insight into the future of television. Other media that function within the logics of publishing industries such as books, recorded music, and videogames all feature far more asynchronous engagement and thus illustrate possible strategies for internet-delivered television. Of course, time matters to these industries; the moment of initial release of content is inevitably a peak moment of consumption, especially for goods with known properties and industries that push audiences to consume in the first window of availability. But because these internet-distributed media do not have capacity constraints such as a channel schedule, matters of time are not embedded so deeply into their logics.

By way of closing this preliminary discussion of emergent logics of a new distribution mechanism for an old medium, I provocatively question how television might operate if it were to follow the conventions of a natively nonlinear medium such as the book industry. Again, this is not a thought experiment relevant to all forms of television, but it is one that has significant potential for reconceptualizing competitive practices and the industrial logics of scripted series.