"C'est comme ça que vous entendez les affaires?"

: This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 3.0 License. Please contact [email protected] to use this work in a way not covered by the license.

For more information, read Michigan Publishing's access and usage policy.

By the end of the nineteenth century, it was commonplace among economic and political observers to refer to the French as a nation of savers and investors.[1] The countryside, it was declared, was ripe with the savings of the working- and middle-classes, overflowing in bedroom drawers and stuffed into woolen stockings. The tendency of the average Frenchman to accumulate capital, however modest, was both a boon and bane to the national economy. In the years immediately following the Franco-Prussian war, for example, it was the seemingly endless supplies of savings pouring forth to invest in national bonds that liberated the territory from the occupying Prussian army.[2] Yet the preference of French investors for solid and reliable returns was also blamed for poor domestic investment in industrial and commercial enterprise. As one business journal from 1899 remarked, "It is well known that in France, when an enterprise born of the spirit of initiative and requiring bold and calculated investment presents itself, it finds capital only in appealing to the outside, but for safe enterprises, offering every security, our nest eggs beg to be opened."[3] While historians have called into question the degree to which French enterprises of the second industrial revolution were in fact struggling for capital, the penchant of French savers for low-interest, high-security investments was sufficient to establish the rentier—an individual living from the interests of their investments, traditionally in government bonds or rentes—as the nation's predominant economic identity both at home and abroad.[4] In 1908, for example, German Chancellor von Bülow commented in the Reichstag that "France owes its wealth . . . to its remarkable spirit of economy, to the capacity for saving that distinguishes every Frenchman and Frenchwoman. France has become the world's banker. Where France falls short of us in production . . . it compensates in the interests of its savings."[5]

This paper engages the figure of the gogo as a method of exploring the changing attitudes and practices of nineteenth-century Frenchmen with regards to savings, investment, and speculation. First appearing in the 1830s, the gogo is a duped shareholder, a complicit victim to the financial schemes of ill-prepared or ill-intentioned entrepreneurs.[6] He is a comedic and compulsive character who rushes to buy shares in railroads to the moon or windows made of rubber, enthralled by publicity campaigns and powerless before promises of extraordinary returns. By the end of the century, however, the gogo often appears in a new light, shifting genres from comedy to tragedy and acquiring a new moral valence as both the demography and geography of marketplace participation expands. Using the gogo to reconstruct the moral parameters of the financial marketplace helps to illuminate the process by which French savings moved from accumulating in drawers to accumulating interest—in other words, how the financial market came to occupy a legitimate and quotidian place in French economic and political life.

The Financial Marketplace in the Nineteenth Century

The financial marketplace in the nineteenth century constitutes a little known theatre of French economic modernity. Historians of French economic development continue to focus either on the activities of its industrialists—characterizations that remain dictated by the debate about France's "special path" of industrial modernization—or, at the other end of the spectrum, the behavior of consumers. This leaves unexplored the emergence of an increasingly democratized financial arena that revolutionized the relationship of even modest households to the marketplace.[7] In a series "The Financial Mores of France," which ran in the Revue des Deux Mondes throughout the 1870s and 1880s, Alexis Bailleux de Marisy observed that mobile wealth—stock and bond ownership—was more democratized in France than in any other country in the world. He argued that, owing to their great propensity for savings, French citizens engaged in moveable investments in a proportion far greater than that of either Great Britain or the United States.[8] Alfred Neymarck, a longtime member of the Society of Political Economy and editor of the journal Rentier, spent decades combating popular impressions of a "financial plutocracy." He illustrated repeatedly that the vast majority of French mobile wealth was in the hands of what he called "the laboring classes" or a "proletariat of securities holders," which was made up of "small savers who, with a few hundred or a few thousand francs to spare, bought or subscribed to one or a few shares in various companies."[9] Stocks, he advised savers in his 1913 advice manual for investment, had become "a basic consumer good" as well as an agent of democratic stability, bringing together labor and capital in the common goal of national productivity.[10]

While the barrier for participating in stock ownership remained insurmountable for the majority of the nation's working classes, they were nevertheless integrated into financial markets through the multiplication of savings banks and capitalization institutions across the country in the last decades of the nineteenth century. The amount of money entrusted to the national Caisses d'Épargne (Savings Banks), a network of institutions founded in the early nineteenth century to encourage thrift among the working classes, increased nearly six times between 1870 and 1904, from 660 million to 4,333 million francs, while the number of individuals holding bank books grew from approximately two million in 1869 to 11.5 million in 1904.[11] Indeed, in 1895 the legislature reduced the maximum permitted in accounts from two thousand francs to fifteen hundred francs in an effort to ensure that accumulated capital found its way to investments rather than remaining essentially unproductive.[12] The early Third Republic saw the most significant expansion of large national banks such as the Société Générale, the Crédit Lyonnais, and the Comptoir d'Escompte; the number of provincial branches of these institutions stood at forty-seven in 1870, and exploded to 1303 in 1912.[13] Accompanying this institutional growth was a variety of sales techniques designed to convince small savers to part with their nest eggs and confide their capital to the new financial organizations. Finance grew close to the commercial realm as "financial department stores" peppered the country in a manner analogous to the Louvre or the Bon Marché.[14] Financial establishments even became an acknowledged element of the spectacle of Paris. Reporting on the appearance of Paris from the perspective of a tourist in 1882, L'Illustration noted: "A foreigner visiting Paris could note the following impressions in their notebook: The appearance of the capital of France: A wine merchant. A banking house. A tobacconist. A credit bureau. A panorama. A café. Another wine merchant. Another financial house . . . voilà Paris!"[15]

The expansion of credit institutions, derided as "stock stores" by their opponents, aimed to diversify and enlarge the market for the placement of new stock and bond offerings.[16] The explosion of the financial press in the early Third Republic greatly assisted this diversification. From only thirty-nine financial circulars in the country in 1873, the number grew to 150 in 1881, and on to 242 by 1904.[17] Laws in 1864, 1870, and 1883 lowered the minimum inscription in the national debt to as low as two francs, while the law of 1893 lowered the minimum corporate share to twenty-five and one hundred francs, depending on the size of the company.[18] Those who could not come up with the funds necessary for these investments immediately could buy portions of shares or buy on installment plans. These plans were particularly important for the democratization of lottery bonds. Lottery bonds, issued under authorization of the state, were bonds eligible for drawings like lottery tickets, in addition to acting as a routine form of long-term investment. The lottery had been prohibited in France from 1836, and it was not until the end of the Second Empire that jurisprudence arrived at a consensus with regards to the exceptional legality of these bonds.[19] It was a thorny matter that would continue to trouble jurists as well as a range of economic and social commentators, particularly once these bonds began being sold on installment plans in the 1880s, thus reaching into the purses of even the most modest households. As with the expansion of credit institutions, the sale of these lottery bonds by door-to-door salesmen, known as démarcheurs, changed the geography as well as the demography of engagement in the marketplace, with the financial networks of the nation's principal cities extending out into the countryside to force open its family vaults, however humble. Despite repeated efforts to regulate or even suppress the activities of these brokers in the name of the newly vulnerable category la petite épargne (small savers), the conviction that these bonds were uniquely capable of engendering positive practices of thrift and investment among the working classes prevented the imposition of any major impediment to their expanding marketplace.[20]

Dupery in the Financial Sphere—The Gogo

In order to better comprehend how this financial revolution was understood and constructed by contemporaries, for the remainder of this discussion let us turn to the figure of the gogo, or financial dupe. Broadly speaking, nineteenth-century jurisprudence remained conflicted on the status of the dupe in swindling cases. Legal opinion in the first half of the century defined swindling specifically with regard to the character, education, and faculties of the defrauded party. Individuals, it was deemed, lacked the right to be unwary and expect the protection of the law to substitute for their own vigilance; thus, determining whether the criminal act of swindling had taken place required a case-by-case analysis of the capacities of the dupe. This view was out of favor by the latter part of the century, having been largely trumped by the consideration that the act of swindling was hurtful to society as a whole regardless of the potential recklessness of the injured party.[21] Such a change indicates a recognition of both the difficulty of protecting oneself in an increasingly democratized and anonymous marketplace as well as the changed place of market relations with regard to the collective. A swindle, previously a personal injury, is here acknowledged as a threat to the social body as a whole. This shift did not, however, mean that the so-called "complicity" of the dupe ceased to play a role in judicial proceedings or that "capable" marks could on occasion find themselves without recourse in the courts. In 1908, jurist G. Grandjean summarized the liberal position on marketplace responsibility succinctly when he wrote: "there ought to be no infraction in those instances where it would suffice to inform oneself in order to avoid the trap . . . Justice is not responsible for defending those who choose not to defend themselves."[22]

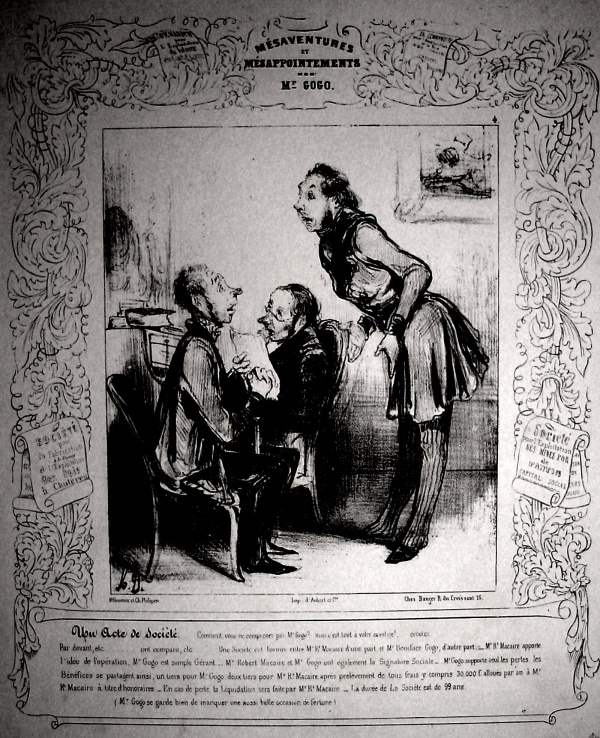

The question of complicity is especially pertinent to the gogo. The French public was introduced to the personage of "Monsieur Gogo" in the wildly popular 1834 play Robert Macaire, which made Macaire the embodiment of the scheming speculator who epitomized the booming 1820s and 1830s.[23] Thanks to the uproarious stage performance of Frédérick Lemaître and the fêted series of caricatures by Honoré Daumier, Macaire established the epoch as one characterized by a novel relationship of the masses to business and finance in which his flocks of eager shareholders play a critical part. [24] As a chronicler of the life of a gogo would write of this interdependence in 1840, "Gogos and Macaires are two ancient branches of the same family."[25] In his first appearance, Monsieur Gogo is the only named character among Macaire's general assembly of shareholders. Having invested in the swindler's theft insurance venture, he interrupts Macaire's report with demands for his dividend. Macaire scoffs at the quaint request and dismisses him, interjecting haughtily, "Sir, is that how you think business works?"[26] Gogo is quickly ejected from the assembly as the other shareholders jump to invest in Macaire's new business. As was the case for Macaire, it is Daumier's caricatures, this time an 1838 series entitled "The Misadventures and Disappointments of M. Gogo," which provides us with a more elaborate and influential depiction of the figure.[27] Gogo emerges from this short-lived series, published in La Caricature provisoire, as a contrite but ultimately irrepressible stock market participant. Daumier shows him appealing to both his mother and the father of his fiancée for capital to invest in business ventures, as well as foolishly confiding his father's legacy to the director of the company already responsible for losing the bulk of it. He appears in one lithograph with Robert Macaire, who has convinced him that the company they are forming together is a wonderful business opportunity despite the fact that Monsieur Gogo has agreed to suffer all losses in exchange for only one-third of the profits (see Figure 1). The world of the rentier, symbolized by the traditional economic resources of dowry, inheritance, and reliable capital returns on investments, is turned upside down as the gogo emerges under the guidance of Robert Macaire as a hapless and enthusiastic shareholder.

The rentier and gogo thus remain closely linked. In his entry on the "rentier" for the famous 1840 collection of physiognomies, Les Français peints par eux-mêmes, Balzac noted that it was one of his twelve species of rentier that gave society the gogo, an investor who "wouldn't lend to an honorable man the thousand francs he holds ready for the most thieving of enterprises."[28] The gogo of the July Monarchy was the confederate of the Robert Macaires, a man eager to multiply his savings at the exorbitant rate that only the riskiest—and most ridiculous—ventures could promise. This gogo was born of the sudden expansion of investment practices into the realm of industrial and commercial enterprise, a movement which brought the worlds of investment and speculation into closer proximity. In a fashion consistent with the historigraphical treatment of French entrepreneurialism as fundamentally risk-averse, with the gogo the investors' foray into industrial shareholding is lampooned as blindly credulous. The gogo may think himself the "friend of progress"; he may, in an expression of true entrepreneurial spirit, insist that "without me, I think nothing would ever have been done . . . Well do I know that not everything on earth succeeds, but I also know that nothing can succeed which hasn't been tried." Yet such unmitigated enthusiasm for industry served only to rob him of his fortune and security.[29]

The gogo followed economic booms and busts. Following the market fizzle of 1856–1857, Daumier's publisher Philipon introduced a new series of caricatures in the Journal Amusant. In 1859, Frédérick Lemaître fils tackled the counterpart of Robert Macaire in the popular play Monsieur Gogo.[30] In this play, Gogo is a wealthy retired furrier who finds himself the prey of shopkeepers and stock speculators owing to both his desire for social and cultural distinction and his absolute incapacity to recognize dishonesty. Yet his overabundant confidence does not prevent Gogo from emerging triumphant in this instance, and he is sufficiently alarmed for his fortune by the end of the play to successfully dupe those who have been robbing him. Gogo learns his lesson, and he retires from the world of speculative money-making to enjoy a quiet domestic life with his new young wife, admitting that "the good bourgeois of Paris" are poorly equipped—both in terms of skill and duplicity—to swim in the worldly waters of finance.[31] This depiction of the gogo opposes the virtuous realm of commerce, characterized by honesty, labor, and fraternity, to that of the financial marketplace, an arena in which participants must seemingly choose between only two possible roles, to be a swindler or to be swindled.[32]

Monsieur Gogo's trust in his fellow men became the defining characteristic of the Third Republic gogo. A financial journal from 1879 entitled Le petit gogo gave the following definition of its moniker: "above all a careless individual whose investments are ill-considered as well as bad. This careless person, moreover, is frequently enough quite honorable, for often his absolute honesty prohibits him from easily assuming that others are duplicitous." Furthermore, the author continued, the term gogo could also refer "to very intelligent men, normally very capable, who made a bad investment based on tempting but false information, against which they could not be, or at least were not, warned." [33] In other words, the market could create dupes out of any investor because of the extreme difficulty of ensuring the accuracy of information. Legislators who liberalized the joint-stock company in 1867 recognized this difficulty and included in their law new stipulations making it easier to charge a company with fraud than it would be to charge an individual. While part of the intention of this liberalization was to diffuse more broadly responsibility and vigilance in the marketplace, these stipulations also recognized the limits of that competence.[34] If the diversifications of objects of financial investment in the July Monarchy gave birth to an image of the shareholder as a credulous and comedic dupe, the democratization of marketplace participation from the 1880s onwards created the space for the shareholder to don a tragic persona. The short-lived journal Le gogo satirique lamented in 1884 that "the gogo, born of the Stock Exchange and its trickeries, prey of shameless financiers . . . has spread enormously."[35] This spread coincided with—and was, in fact, the result of—financial scandals on a scale not witnessed since the experiments of John Law in the early eighteenth century, scandals which were moreover deeply linked to institutions of political and cultural authority. The Union générale and the Crédit de France were both Catholic credit institutions that collapsed in 1882, followed a decade later by the Panama Canal scandal that implicated over a hundred state officials. A financial journal remarked in 1881, "[w]e have decidedly entered a new financial era which promises nothing good. Everywhere the game is afoot between dupers and dupes."[36]

The gogo, while not exempt from blame for the tragedies that befell him (or, increasingly, her) was more the victim of dishonest market actors than of his or her own greed. The gogo became available as a moral, even righteous, status from which to expose the corruption of the financial sphere. Writing in 1884, an author who signed himself "A Gogo" sought to defend "these good folk, who financial pirates like to refer to as gogos."[37] Describing impoverished attic apartments and shattered dreams, the author admonished these shareholders for their credulity, but at the same time sought to open the eyes of the public to the range of small savers participating in the stock market and left to face anonymous enterprises without protection. The potential social space of gogoisme had expanded considerably by the time of the Third Republic; from an overly-enthusiastic rentier badly employing his income, the gogo could be described in 1903 as originating amongst small tradesmen, employees, and churchmen, from "amongst all those who, not having a fortune, have the legitimate desire to make their modest savings profitable, in order to protect themselves from want."[38] This last description provides us with one of the most important clues about the fundamental changes that structured the experience of the financial marketplace as the nineteenth century progressed. While the gogo could be mocked for his ill-advised forays into the stock market in the 1830s, by the end of the century making one's money productive was a perfectly legitimate desire that risked being thwarted by a lack of market regulation and basic financial education. Indeed, leaving one's money unproductive was criticized repeatedly as at best irresponsible and at worst a betrayal of the national interest. As Alfred Neymarck advised investors in 1913: “There can no longer be any question nowadays of piling coins in a drawer or shoving them in a hiding place. The days of the traditional woolen stocking are gone; we know only too well the value of money, and the possibilities of making it fruitful are too many to leave it unproductive.” Money that is not made to work, he insisted, is lost, and “not only for the owner, but for the whole.”[39]

Conclusion

The figure of the gogo did not, of course, lose all capacity for comedy by the end of the century. He continued to appear in plays and popular writings as a buffoon—and one often entirely responsible for his own losses. For example, in the serialized play by A. Hervo, La grève des boulangers, which appeared in La Semaine des familles in 1880, M. Gogo arrives to invest in a fake company as soon as its publicity campaign is launched, and confesses to the director his own shady financial dealings. Yet pleas for the honour and protection of the average gogo continued. [40] In one of the most interesting examples of such works, Henri Morieux's Mémoires d'un gogo (1903), the author is at once a self-described gogo and a former financier, responsible for launching various financial ventures and losing the savings of many investors.[41] The fluidity between victim and perpetrator remained, reflecting uncertainty about the potential for responsible self-making in the marketplace. Increasingly, however, the complicity of the victim was limited to his or her inexperience and fundamental honesty, and, far from recommending a withdrawal from the financial realm, the increased legitimacy of stock market activity meant that individuals were instead expected to cultivate skepticism and undertake investment with the same application with which one would approach a profession. The gogo provides a window—both to the historian and the nineteenth-century French— through which to conceptualize the relationship of individuals to the marketplace. The gogo's travels from hilarious, inept operator to honorable but vulnerable investor not only illuminates the increasing legitimacy and significance of the financial marketplace in national economic life, but also prompts a reevaluation of the quotidian monetary practices of the average French citizen as the productivity of money became an ever-more-normalized pursuit.

- *

This essay is based on research for my forthcoming dissertation, "Selling Paris: The Real Estate Market and Commercial Culture in the Nineteenth-Century Capital."

See, for example, the series of articles in the Revue des deux mondes on the "Moeurs Financières de la France": A. Bailleux de Marisy, "Les Valeurs Étrangères" (1 July 1872): 198-211; "Les Sociétés de Crédit" (15 November 1876): 410-31; "Le Papier-Monnaie—Les Impôts de la Guerre—Les Travaux de la Paix " (15 November 1873): 389-406; "Les Valeurs Orientales, les Finances de la Turquie et de l'Égypte" (1 October 1874): 650-78; "Le Parquet des Agents de Change de Paris" (1 October 1875): 605-25; "Le Prêt à l'Intérêt" (15 February 1878): 923-42; "Les Nouvelles sociétés foncières" (15 November 1881): 432-52; "Les Titres des sociétés de chemins de fer" (15 June 1882): 755-82.

Several commentators noted the patriotism of French financial activity with regards to these loans and the subsequent economic recovery of the country. See de Marisy, "Le Parquet des Agents de Change de Paris," and Alfred Neymarck, Finances contemporaines, vol. 7, La fortune mobilière de la France (Paris: Guillaumin et Cie, 1902-1911), 202-03.

Thomas Tonnelier, "Affaires. Gens d'affaires et genre d'affaires," La Revue Immobilière et Industrielle: Circulaire mensuelle de négociations d'affaires industrielles et d'emprunts, no. 36 (February 1899): n.p. All translations from the French are my own.

Charles E. Freedeman, The Triumph of Corporate Capitalism in France, 1867–1914 (Rochester: University of Rochester Press, 1993). Contemporaries also pointed to the abundance of capital for domestic investment needs, while calling into question facile—and hostile—characterizations of France's tendencies to export capital. See, for example, Yves Guyot, "The Amount, Nature, and Direction of French Investments," Annals of the American Academy of Political and Social Science, vol. 68, America's Changing Investment Market (1916): 36-54.

The origins of the term "gogo" remain uncertain. Some linguists see its root in the phonetic doubling of the last syllable of the term nigaud, meaning "sucker." Others attribute its origin to the archaic term gogoyer, meaning to mock or taunt. Finally, one dictionary places its origin in the common phrase à gogo, referring to a person who falls for promises of abundance. Lorédan Larchey, Dictionnaire historique d'argot (Paris, 1881); Alfred Delvau, Dictionnaire de la langue verte (Paris, 1883); Lucien Rigaud, Dictionnaire d'argot moderne (Paris, 1881).

For an excellent recent review of the historiographic swings and the political stakes in the theorization of France's nineteenth-century economic development, see François Crouzet, "The historiography of French economic growth in the nineteenth century," Economic History Review 56, no. 2 (2003): 215-42. The most influential characterizations of French entrepreneurialism are those of David Landes, for example, "French Entrepreneurship and Industrial Growth in the Nineteenth Century," Journal of Economic History 9, no. 1 (1949): 45-61. See also the recent works of Michael S. Smith, The Emergence of Modern Business Enterprise in France, 1800–1930 (Cambridge: Harvard University Press, 2006) and Jeff Horn The Path Not Taken: French Industrialization in the Age of Revolution, 1750–1830 (Cambridge, MA: MIT Press, 2006).

A. Bailleux de Marisy, "Le Prêt à l'Intérêt," Revue des deux mondes (15 February 1878): 923-42. On French investment in the late nineteenth century, see Hubert Bonin, L'argent en France depuis 1880: Banquiers, financiers, épargnants dans la vie économique et politique (Paris: Masson, 1989), chapter nine. On the rise of mainstreet investors in the United States and Great Britain, see Julia Ott "When Wall Street Met Main Street: The Quest for an Investors' Democracy and the Emergence of the Retail Investor in the United States, 1890–1930," Enterprise and Society 9, no. 4 (2008): 619-30; Alex Preda "The Rise of the Popular Investor: Financial Knowledge and Investing in England and France, 1840-1880," The Sociological Quarterly 42, no. 2 (2001): 205-32.

Alfred Neymarck, Le morcellement des valeurs mobilières: Les salaires, la part du capital et du travail (Paris, 1896), 23.

Alfred Neymarck, Que doit-on faire de son argent? Notions et conseils pratiques sur les valeurs mobilières. Placements et opérations (Paris: Marchal et Godde, 1913), 38. The late nineteenth century saw increasing efforts to engage the working classes in stock ownership as an alternative to unattainable forms of property ownership, such as real estate, and as a method of linking labor to capital. See Henri Mouret, Sociétés anonymes à participation ouvrière et actions de travail (Paris: Librairie générale de droit et de jurisprudence, 1919), introduction and chapter one.

Alfred Neymarck, Le développement annuel de l'épargne française: Le crédit de l'état, leur rapport et leur utilité pour notre commerce et notre industrie (Paris: Alcan, 1906), 11. See also Hubert Bonin, L'argent en France, chapter four.

Archives de la Chambre de commerce et d'industrie de Paris (hereafter CCIP), III–6.16 (9): "Caisses d'épargne, Caisse des prêts mobiliers, etc," "Proposition de loi tendant à modifier la loi du 20 juillet 1895 sur les Caisses d'épargne. Présentée par M. Gauthier (de Clagny), député. Chambre des Députés, no. 565, 3 décembre 1902."

The term "grands magasins financiers" was often employed by liberal economist Paul Leory-Beaulieu. See Lysis [pseud. Eugène Letailleur], Contre l'oligarchie financière en France (Paris: Aux Bureaux de La Revue, 1908), 15-16.

"Courrier de Paris," L'Illustration 79 (28 January 1882): 2031.

See Claudio Jannet, Le capital, la spéculation et la finance au XIXe siècle (Paris, 1892), 157. The phrase "magasins de valeurs" is employed in the investment advice manual of Jacques Bainville, Après la guerre: Comment placer sa fortune (Paris: Nouvelle Librairie Nationale, 1919), 216.

Based on a review of Annuaire de la presse française et du monde politique (which was published at Paris and which, in 1891, became Annuaire de la presse française et du monde politique) from 1880–1904; Bonin, L'argent en France, 241.

See Pierre-Cyrille Hautecoeur, ed., Le marché financier français au XIXe siècle, vol. 1, Récit, (Paris: Publications de la Sorbonne, 2007), especially chapter nine.

Henri Lévy-Ullman, "Lottery Bonds in France and the Principal Countries of Europe," Harvard Law Review 9, no. 6 (1896): 386-405 and Traité des obligations à primes et à lots (thèse pour le doctorat, Faculté de droit de Paris, 1895).

The law of 12 March 1900 normalized the sale of lottery bonds on credit, and imposed basic regulations on their sale (such as transparency as to cost and value, as well as limiting the maximum payment period to two years). For the linkage of these sales to the burgeoning fin-de-siècle field of asset capitalization, see Eugène Rochetin, "Les caisses de capitalisation ou les imprévoyants de l'avenir," Journal des Economistes, no. 2 (1893): 165-97; for a history of legislation on this question, see the records of the renewed regulatory effort in the interwar period, CCIP, III–6.15 (3): "Vente à crédit des valeurs à lots, 1921–1925."

Albert Lenoël, "L'escroquerie est-elle punissable malgré l'imprudence de la dupe?," Revue pratique de droit français (extrait) (Paris, 1878); Louis David, Étude théorique et pratique sur le délit d'escroquerie (Paris, 1883).

G. Grandjean, Étude pratique du délit d'escroquerie dans la société par actions (Paris : Librairie de jurisprudence, 1908), 23.

In the entry for "Speculator" in Les Français peints par eux-mêmes, the speculator is described as "the character par excellence of the current era, the dominant figure of the present generation, the image of the century of money," and contemporary society as "a cave of Robert Macaires." M. le vicomte d'Arlincourt, "Le spéculateur," Les Français peints par eux-mêmes (Paris, 1840), 1:573-4.

Daumier's series appeared in Le Charivari from 1836 to 1838, and was published as Les cent-et-un Robert Macaire in 1839. Daumier published another Robert Macaire series in Le Charivari from 1840-1842. For more information on the theatrical and graphic treatments of Macaire, see Jean Adhémar, ed., Financial and Businessmen (Robert Macaire) (Paris and New York: Leon Ameil Publisher, Inc., 1974), and Catherine Couré's accompanying text to L'Auberge des Adrets (mélodrame en 3 actes), Robert Macaire (pièce en 4 actes et 6 tableaux) (Grenoble: Roissard, 1967). For a more recent treatment, see Christophe Reffait, La Bourse dans le roman du second XIXe siècle. Discours romanesque et imaginaire social de la spéculation (Paris: Champion, 2007), 106.

M. Lagobe, La vie de l'illustre M. Gogo: Tribulations, désappointements, gaucheries, crédulités, brioches et cornichonneries d'un melon social (Paris, 1840), 6.

The short-lived series, amounting to only five lithographs, was intended to help the publisher Charles Philipon launch his new journal, La Caricature provisoire. On Daumier's series and the treatment of a "cultural" gogo by the caricaturist Cham, see David Kunzle, History of the Comic Strip, vol. 2, The Nineteenth Century (Berkeley: University of California Press, 1990), chapter three.

Honoré de Balzac, "Monographie du Rentier," in Les Français peints par eux-mêmes (Paris, 1840), 3:12.

Lagobe, La vie, 15, 11. David Landes has most influentially and elegantly argued the characterization of French entrepreneurialism as fundamentally Malthusian. See aforementioned work and "L'esprit d'entreprise en France," Nouvelle Revue de l'Économie Contemporaine, no. 48 (1953): 4-13; "French Business and the Businessman: A Social and Cultural Analysis," in Edward Mead Earle, ed., Modern France: Problems of the Third and Fourth Republics (New York: Russell and Russell, 1964), 336-52; "Religion and Enterprise: The Case of the French Textile Industry," in Edward C. Carter, H. Robert Forster, and Joseph N. Moody, eds., Enterprise and Entrepreneurs in Nineteenth-century France (Baltimore: Johns Hopkins University Press, 1976), 41-86; for his response to historians who have used his generalizations about the nature of French entrepreneurialism as a straw man, "New-Model Entrepreneurship in France and Problems of Historical Explanation," Explorations in Entrepreneurial History, 2nd ser, 1, no. 1 (1963): 56-75.

Paul de Kock et Frédérick Lemaître fils, Monsieur Gogo (comédie-vaudeville en cinq actes) (Paris, 1859).

Amalia Kessler has recently shown the importance of fraternal notions of trust to Old Regime commercial relations; A Revolution in Commerce: the Parisian merchant court and the rise of commercial society in eighteenth-century France (New Haven: Yale University Press, 2007).

A. C., "Observations à propos du titre de ce journal," Le petit gogo: Critique financière et compte-rendu des assemblées d'actionnaires (23 May 1879): 3.

On the desire to diffuse responsibility and vigilance, see Anon., Sociétés anonymes: Observations sur le projet de loi présenté au Corps Législatif (Paris, 1866) ; for more on limited-liability companies and fraud, Grandjean, Étude pratique.

"Gogo," Le gogo satirique, politique et financier, no. 1 (10 May 1884): 1.

"La reconstitution de l'épargne," Le contentieux financier: Organe des actionnaires et des obligataires, no. 8 (1 March 1881): 2.

Grandeur et décadence d'une société financière, par un Gogo (Paris, 1884), 5.

Henri Morieux, Les mémoires d'un Gogo (Lille: Camille Robbe, 1903), 6.

See La Semaine des familles, no. 33 (13 November 1880), no. 34 (20 November 1880). The gogo could also appear in arenas not directly related to finance as a gullible dupe, e.g. Edgard Favart, Le docteur gogo (comédie bouffe en un acte) (Paris: Georges Ondet, 1905).

Henri Morieux, Autobiographie: Les mémoires d'un gogo (Lille: C. Robbe, 1903).