A Living Wage as a Prescription for Working Families

Skip other details (including permanent urls, DOI, citation information)

: This work is protected by copyright and may be linked to without seeking permission. Permission must be received for subsequent distribution in print or electronically. Please contact [email protected] for more information.

For more information, read Michigan Publishing's access and usage policy.

Abstract

The stress that the economy places on families has increased in recent decades, making women's earnings crucial to economic survival. This article summarizes the estimated impact of adopting a nationwide policy of comparable worth to reduce wage discrimination in underpaid, predominantly female occupations, where the majority of women are employed. Pay equity would reduce poverty and inequality significantly, helping to provide a living wage for working families.

Key words: pay equity, comparable worth, poverty, inequality, gender discrimination, wages

Deborah M. Figart, Ph.D., is Associate Professor, Department of Economics, Richard Stockton College of New Jersey, Jim Leeds Road, Pomona, New Jersey, 08240-0195.

The stress that the economy places on families has increased in recent decades. Family members are working longer hours to maintain their desired standard of living. Specifically, full-time, year round workers in the United States worked the equivalent of 138 more days per year in 1989 than 1969 (Leete & Schor, 1994). People have less time for their children, less time for community and civic activities, and less time for leisure. Despite increases in labor productivity, real wages (after inflation) have been declining, especially for male workers. Fewer workers earn a living wage, that is, enough to support a family of four above the federal poverty line. After ten years of slow growth, family income actually fell in the early 1990s. Pressure is especially great among young people starting families, since they have faced the largest income declines (Schor, 1991; Folbre & The Center for Popular Economics, 1995; Sweeney, 1996).

The number of labor market hours a family can supply has become the primary factor determining where they are on the economic ladder. More Americans are working overtime or in multiple jobs. Family structure plays a role in whether they keep their heads above water, with two-earner families faring better than one. Only the increased work hours and income by wives has cushioned the fall in family earnings (Tilly & Albelda, 1994; Mishel & Bernstein, 1994). Women of all ages and all demographic groups, with and without children, are full participants in the workforce over the life cycle. A recent survey conducted by the Center for Policy Alternatives in Washington, D.C. found that 64% of working women and 54% of married women said that they were earning half or more of the income in their families.[2]

Single earner families, especially those headed by women, are on the lower rungs of the ladder. Despite the myths about poor women, many welfare recipients combine public assistance with wages. The Institute for Women's Policy Research in Washington, D.C. has shown that about 40% of Aid to Families with Dependent Children (AFDC) recipients already worked half-time over a two-year period (Spalter-Roth, Hartmann, & Andrews, 1992). The major problem is that they earn poverty-level wages. Changes in public assistance are making their balancing act more difficult. State and national welfare reform measures cut off benefits after two years (and cap benefits at five years over a lifetime) without providing much training or a guarantee of jobs paying a living wage. Further, the constant dollar value of welfare is shrinking and is likely to continue to fall as a result of the new federal block grants which replace the AFDC entitlement. Without labor market reform, welfare reform may succeed in moving women and children off welfare rolls but not out of poverty.

Policy debates across the United States have increasingly focused on the need for good jobs at good wages; however, less attention is given to women who work to support families. Gender discrimination in low-wage labor markets is often overlooked. The work that women do is undervalued, underpaid, or unpaid, causing families severe economic hardship. One singular statistic has been the impetus around which we gauge improvements in the labor market position of women. The call for "pay equity" evolved politically in reaction to this one economic indicator, the gender-based wage gap. If there were no wage gap by gender, the ratio of male-to-female average or median wages would be 100%. Any deviation below 100% means that women, on average, earn less than men. The wage gap can be calculated for all workers or for year-round full-time workers using weekly or annual earnings. Comparing median weekly earnings for full-time year-round workers (which typically yields a smaller gap), the ratio of female-to-male earnings is about 75% in 1996, meaning the wage gap is 25%. In other words, women average at least 25 cents less than men for each dollar of earnings. African American women and Hispanic women have higher wage gaps of 34 cents and 43 cents respectively. According to the National Committee on Pay Equity, an average woman worker had to work full-time in 1995 and for three and one-half months in 1996 (until April 11) to earn the same amount of money that an average male worker earned by working full-time in 1995.

The problem of unequal pay has been with us for a long time. A wage gap of 40 cents in the 1960s has eroded to only a quarter today, with a ten-cent narrowing in the 1980s due in part to the decline in men's real earnings rather than the improvement in women's pay. The primary reason the wage gap persists is that millions of women do not work side by side doing the same work as men. They perform gender-segregated work. Six out of ten women and eight out of ten men work in gender-dominated jobs, or occupations whose gender composition is at least 70% female or male. Women's jobs developed historically under the assumption that women did not (and should not) support families by themselves. Studies have shown that as percent female in an occupation rises, average earnings fall, penalizing these jobholders.

Comparable worth, or pay equity, is a remedy for wage discrimination against female-dominated and minority-concentrated job categories when the undervaluation of work done by women and people of color is reflected in market wages. It is a policy requiring equal pay for work of comparable value to an individual employer, that is, when jobs require comparable levels of skill, effort, and responsibility and comparable working conditions. The goals are to raise wages of workers in female-dominated (or minority-concentrated) occupations and eliminate discriminatory pay scales by setting wages according to job-related factors, not who usually works in the job (by race or gender).

Current equality policies have not alleviated the wage gap. The Equal Pay Act of 1963 requires employers to pay equal pay for equal work. Equal work means the same job for the same employer. However, even with integration by gender within broad job categories—such as manager, salesperson, and attorney, for example—intraoccupational segregation is prevalent. Men and women hold the same general occupational title but are segregated into different specialties, different kinds of workplaces, or different career tracks. Although equal employment opportunity and affirmative action policies have opened many doors, doing "men's work" isn't enough. Jobs are not expanding in traditionally male manufacturing industries and middle management is being downsized.

In the last decade, the fastest growing industries were health care, financial services, and business services. While the service sector has produced more professional and managerial jobs than existed in manufacturing, it has also expanded employment in low-wage occupations, especially for workers without college degrees. In fact, the largest numbers of new jobs are being created in underpaid female-dominated and disproportionately minority occupations. According to the Bureau of Labor Statistics, the occupations with largest absolute growth include cashiers, registered nurses, janitors and cleaners, food preparation workers, and secretaries. Concerns have been expressed that middle-class jobs are disappearing. After a period of movement toward earnings equality for three decades in the postwar era, there has been an observed increase in overall inequality since 1979—what economists Bennett Harrison and Barry Bluestone (1988) have termed "The Great U-Turn." Two studies indicate that approximately one fifth of the increase in earnings inequality appears to be explained by the shift from manufacturing to more female-intensive service sector employment (Harrison & Bluestone, 1988; Karoly, 1992). Consider the following statistics that impact women and their families. In female-dominated occupations, over one fourth of women earned less than the hourly wage necessary to bring a family of three above the federal poverty threshold in 1992, $5.65 per hour or approximately $11,300 per year. Poverty levels in female-dominated occupations are high, ranging from 15% in administrative support to 54% in "other services." Six of ten minimum wage workers are women, and about half of them are supporting families (Mishel, Bernstein, & Rasell, 1995). This finding suggests that policies which target female-dominated occupations for wage increases could also have an impact on poverty and inequality.

Pay Equity Means More Money for Families

A coauthor, June Lapidus from Roosevelt University, and I have completed a series of three studies that estimated the effects of implementing pay equity or comparable worth across the United States. Using a national data set, the March 1992 Current Population Survey (CPS), we have demonstrated the potential of this labor market reform to alleviate poverty and earnings inequality. Because of the discussion about raising the federal minimum wage, we also tested the effect of both a minimum wage hike and a comparable worth policy on increasing earnings and reducing poverty (see Lapidus & Figart, 1994; Figart & Lapidus, 1995, 1996). To approximate implementation of pay equity nationwide, we needed to estimate new wages for each person in the sample who worked in a female-dominated occupation. Bias-free or discrimination-free pay for these workers was calculated by hypothetically eliminating any negative wage penalty associated with performing traditionally women's work.

For the adjusted wages to best approximate how a policy scenario would be realized, some assumptions were used to correspond with pay equity implementation procedures used across the U.S. and Canada. For example, the benefits of comparable worth wage increases are restricted to women and men in female-dominated occupations, defined as 70% or more female. This threshold is the most common, although some public jurisdictions have used more inclusive definitions (as low as 65% female). However, occupations which are less than 70% female nationally may qualify for comparable worth wage adjustments at the individual firm level due to intraoccupational segregation. Examples include social workers, bill or account collectors, office supervisors, food counter clerks, electrical assemblers, educational or vocational counselors, and psychologists. Because public policies such as Title VII of the U.S. Civil Rights Act of 1964 and the Family and Medical Leave Act of 1993 have excluded small firms, the new pay estimates also assume that firms with fewer than 25 employees (at all locations) are excluded from a comparable worth mandate.[3] Finally, no one individual's wage is allowed to drop under the policy correction, mirroring historical precedent in compliance with the Equal Pay Act.

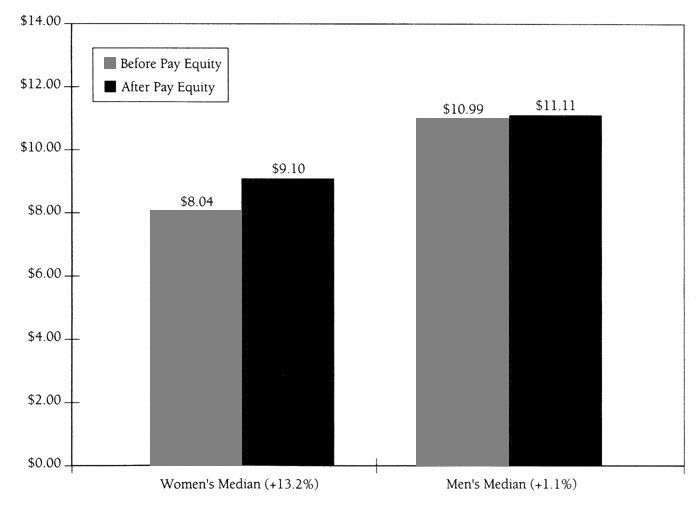

Not surprisingly, we find that pay equity would have a significant impact on women's hourly earnings and the gender-based wage differential. Figure 1 indicates that women's median hourly earnings would increase from $8.04 to $9.10, or 13.2%. The percentage increase in median pay for men is less (1.1%), reflecting the smaller number of men in female-dominated occupations. This translates into a relative increase in the female-to-male wage ratio of nearly 14%, from 72 cents on the dollar to 82 cents, as Figure 2 portrays. These estimates conform to earlier research by economist Elaine Sorensen (1987) on the effect of comparable worth policies on earnings in five states. Since it took the last ten years to reduce the wage gap a dime, the additional ten-cent drop in the wage gap from pay equity would certainly help workers employed in female-dominated jobs and their families.

The approximate increase in hourly wage costs as modeled by these comparable worth wage adjustments is only 3.67%. This expenditure corresponds with the average and median cost of implementation across 20 state governments found by Heidi Hartmann and Stephanie Aaronson (1994). It is lower than the cost as a percent of payroll incurred by implementation of pay equity for civil service employees in Washington, Oregon, Iowa, Connecticut, Vermont, New Mexico, Massachusetts, and Michigan. Furthermore, relatively small pay increases such as these tend to pay for themselves by increasing worker morale and therefore labor productivity.

Pay Equity Also Reduces Women's Poverty

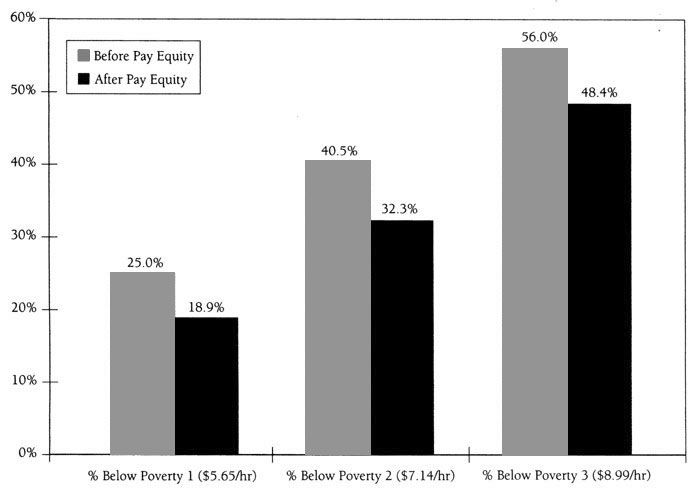

If pay equity were adopted nationally, the percentage of working women below each of three poverty thresholds would decline. These poverty thresholds rely on the concept of adequate earnings, that is, the hourly wage rate which would bring an adult supporting two or three children above the federal poverty line, designated Poverty 1 and Poverty 2. Poverty 1 is the federal poverty line for a family of three with one adult: $11,304 or $5.65 per hour in 1992. Most female-headed families contain three members. Since poor female-headed families average 3.8 members, we also use the federal poverty line for a family of four with one adult and three children: $14,277 or $7.14 per hour. Poverty 3 ($17,980 or $8.99 per hour) is a measure of a female-headed family's basic needs for a family of three, a proposal to amend the federal poverty line by feminist economists Trudi Renwick and Barbara Bergmann (1993). The methodology of the federal poverty line is over 30 years old and does not adequately consider a family's expenses in areas such as child care, health care, or even housing (Albelda, Folbre, & The Center for Popular Economics, 1996).

All the estimated reductions in working women's poverty shown in Figure 3 are large and statistically significant[4]:

- The percentage below Poverty 1 (a family of 2) would fall from 25.0% to 18.9%, a relative decline of 24.4%. (If small employers were also covered by pay equity, the reduction would be nearly 40%).

- The percentage below Poverty 2 (a family of 3) would fall from 40.5% to 32.3% (a relative decline of 20.2%).

- The percentage below Poverty 3 would fall 15.7%, from 56.0% to 48.4%.

Note also from Figure 3 that the decrease in the percent of working women earning poverty-level wages would be greatest (in percentage terms) using the lowest threshold: Poverty 1. This implies that if pay equity were successfully implemented, we would find that poverty would be reduced most among the poorest workers. In fact, relative decreases in poverty for women in particular occupations and industries are substantial—especially women employed in clerical occupations and service industries. Specifically, the decline in poverty among all women who work in female-dominated occupations is 63.6%. Comparable worth nearly eliminates poverty among administrative support (including clerical) workers, a reduction of 74.2%. Poverty rates among women employed in "other service" occupations decline 42.4%. For women working in the "other medical" industry (as home health aides, for example), comparable worth wage adjustments are estimated to decrease poverty by 83.5%.[5] Since a small percentage of men are employed in female-dominated jobs, the reductions in poverty among men under the comparable worth scenario is less; men's overall poverty rate declines only 10.4%. Nevertheless, the decline in poverty among men working in female-dominated occupations is still 50.4%.

Pay Equity Helps Reverse the Squeeze on the Middle Class

Pay equity can also help reverse the increase in earnings inequality and the erosion of living standards in the United States (see Figart & Lapidus, 1996). Female-dominated occupations targeted by pay equity—in administrative support, sales, and service—are typical of the expanding, low-wage sectors frequently imputed to skew the earnings distribution downward. Therefore, a commitment to pay equity could serve to offset longitudinal trends of rising inequality brought about by industrial and occupational restructuring in the U.S. economy. We performed additional simulations involving the same wage adjustments used to estimate reductions in poverty to assess possible changes in earnings inequality under a comparable worth policy.

To test for consistency, five common indexes used in social science research were calculated prior to and after hypothetical pay equity implementation. All of these measures point in the same direction, and indicate substantial decreases in overall earnings inequality, inequality between women and men, and inequality among women. Although the finding that comparable worth would reduce between-gender-group inequality was expected, the estimated reduction in overall and within-group inequality demonstrates the potential of comparable worth to reverse the so-called "declining middle class" by revaluing historically devalued women's occupations. The implication of these findings is that gender inequality is an important dimension of overall inequality.

The extent of the decline in inequality does vary from measure to measure. Reductions in inequality are concentrated in the lower part of the earnings distribution, raising wages of workers at the bottom of the ladder; the indexes that exhibited the largest percentage decreases for women and men are those that best capture changes in the lower tail of the earnings distribution. This indicates that comparable worth potentially reduces earnings inequality by increasing the income of the lowest wage workers, consistent with our earlier findings that comparable worth wage adjustments could reduce the percent of women and men earning poverty-level wages. Pay equity can therefore be conceptualized as a means for minimizing the economic stress among an overworked and disappearing American middle class.

How We Can Make Work Pay

Most pay equity activity in the United States has occurred in the public sector—in state and local governments. In the absence of federal pay equity legislation, coalitions of labor unions, women's organizations, and feminist politicians and administrators inside state and local governments have devoted enormous effort and energy to put pressure on legislators and employers to tackle wage discrimination. According to the National Committee on Pay Equity (NCPE), over 20 states and several localities had adopted some form of pay equity reform for their civil service employees by the 1980s (NCPE, 1989); today the number is over 30. As pointed out by Hartmann and Aaronson (1994), NCPE considers six of these 30 pay equity efforts to be comprehensive because they targeted a broad range of occupations for pay equity wage adjustments. These states are Iowa, Minnesota, New York, Oregon, Washington, and Wisconsin. To strategically implement pay equity, working women and their advocates have used one or more likely a combination of legislation, unilateral action by the executive branch, collective bargaining, and litigation.

The pay equity movement is one solution to the more general problem of securing a living wage for women and men in a global, restructuring economy, as well as a means for challenging gender inequity. Strategies need to reach beyond state government employees and invoke powerful social arguments rather than technical and economistic ones. Increasing the minimum wage to a living wage and improving career ladders in traditionally female jobs are also integral to alleviating wage discrimination. In the long run, national legislation that applies to both the public and private sectors would serve to strengthen local efforts both by setting standards and by making a cultural statement supporting equal pay for work of equal value.

The proposed Fair Pay Act introduced in the 104th Congress attempts to amend the Fair Labor Standards Act of 1938 with explicit comparable worth language. (The Fair Labor Standards Act created a federal minimum wage; the Equal Pay Act of 1963 was an amendment to this Act.) The Fair Pay Act would prohibit different pay for "equivalent jobs" on the basis of gender, race, or national origin. Equivalent jobs is defined to mean "jobs that may be dissimilar, but whose requirements are equivalent, when viewed as a composite of skills, effort, responsibility, and working conditions" (H.R. 1507, S. 1650). The Fair Pay Act does not require employers to file nondiscriminatory job evaluation nor the filing of nondiscriminatory pay plans, as does the 1987 pay equity act in Ontario, Canada. Rather, it would allow individual complaint-triggered litigation on the basis of comparable worth principles, with technical assistance provided to employers, labor organizations, and the public by the Equal Employment Opportunity Commission (EEOC). Most importantly, the Act would require employers to file annual reports with the EEOC that disclose wage rates by occupation or job title as well as the gender, race, and national origin of employees within those positions. It would forbid retaliation against anyone who inquires, discloses, compares, or otherwise discusses wages with any other person. Passage of even some of the act's provisions would serve local organizing purposes. For example, the mere stipulation that wages ought to be public would allow workers to investigate wage scales and make internal and external wage comparisons. In the private sector, where employers often attempt to keep wages secret and present pay as an individual matter, the obfuscation of pay rates for predominantly male and female occupations contributes to inactivity on pay equity. Similarly, regular access to wage information can ensure that pay equity wage adjustments are not a one-time fix. By demystifying internal wage hierarchies and shedding light on employer pay policies, the law might therefore be an important catalyst for local education and action.

According to a poll for the National Committee on Pay Equity, 77% of U.S. voters would support a pay equity law. The responses in the 1992 Center for Policy Alternatives and Ms. Foundation's Women's Voices project and the U.S. Department of Labor Women's Bureau Working Women Count! questionnaire show that equal pay is one of the top priorities of concern for women in the U.S. Pay equity should be linked to other campaigns for economic equity. Fundamentally, this entails addressing the perception that pay equity is primarily an issue benefiting white, middle-class women in female-dominated professions. One option is linking pay equity to anti-poverty campaigns and welfare rights struggles. Efforts to recognize the value of predominantly female jobs need not identify themselves as comparable worth or pay equity campaigns. General economic policy which targets poor, low-paid workers could also help achieve the goal of pay equity. Such policies include regular increases in the federal minimum wage to the level of a living wage, and then indexing it to inflation, assisting workers with meeting the high cost of quality child care, reducing the work week, and extending benefits to part-time workers. As Executive Director of the National Committee on Pay Equity Susan Bianchi-Sand has argued: "Pay equity can and should be considered as one part of a comprehensive strategy to reduce poverty and increase women's economic self-sufficiency" (NCPE, 1996, p. 12).

References

Albelda, R., Folbre, N. & The Center for Popular Economics. (1996). The war on the poor: A defense manual. New York: The New Press.

Figart, D. M., & Lapidus, J. (1995). A gender analysis of U.S. labor market policies for the working poor. Feminist Economics, 1(3), 60-82.

Figart, D. M., & Lapidus, J. (1996). The impact of comparable worth on earnings inequality. Work and Occupations, 23(3), 297-318.

Folbre, N., & The Center for Popular Economics. (1995). The new field guide to the U.S. economy. New York: The New Press.

Harrison, B., & Bluestone, B. (1988). The great U-turn: Corporate restructuring and the polarizing of America. New York: Basic Books.

Hartmann, H., & Aaronson, S. (1994). Pay equity and women's wage increases: success in the states: A model for the nation. Duke Journal of Gender Law and Policy, 1, 69-87.

Karoly, L. (1992). Changes in the distribution of individual earnings in the United States: 1967-1986. Review of Economics and Statistics, 74(1), 107-15.

Lapidus, J., & Figart, D. M. (1994). Comparable worth as an anti-poverty strategy: Evidence from the March 1992 CPS. Review of Radical Political Economics, 26(3), 1-10.

Mishel, L., & Bernstein, J. (1994). The state of working America: 1994-95. Armonk, NY: M.E. Sharpe.

Mishel, L., Bernstein, J., & Rasell, E. (1995, February). Who wins with a higher minimum wage. Washington, DC: Economic Policy Institute.

National Committee on Pay Equity. (1996). Newsnotes. Winter.

Renwick, T. J., & Bergmann, B. R. (1993). A budget-based definition of poverty. The Journal of Human Resources, 28(1), 1-24.

Schor, J. B. (1991). The overworked American: The unexpected decline in leisure. New York: Basic Books.

Sorensen, E. (1987). Effect of comparable worth policies on earnings. Industrial Relations, 26(3), 227-39.

Spalter-Roth, R., Hartmann, H. I., Andrews, L. (1992). Combining work and welfare: An alternative poverty strategy. Washington, DC: Institute for Women's Policy Research.

Sweeney, J. J. (1996). America needs a raise: Fighting for economic security and social justice. New York: Houghton Mifflin.

Tilly, C., & Albelda, R. (1994). Family structure and family earnings: The determinants of earnings differences among family types. Industrial Relations, 33(2), 151-167.

[Notes]

The August 1996 national poll is part of the Women's Voices project, developed in 1992 and sustained by the Center for Policy Alternatives. The purpose is to use public opinion research and economic policy analysis to ensure that women's voices are heard in the public debate.

With the Current Population Survey, the possible choices for number of employees of the firm (at all locations) was under 10, 10 - 24, and 25 - 99. The Ontario, Canada, legislation is less restrictive, it covers private sector employers with ten or more employees.

To test for statistical significance, we used one-tailed t tests. The results were significant at the 1% level.

Decreases in poverty are slightly greater for white women than for African American women, but even larger for women of other races mostly due to the reduction among Asian women. For men by race, the declines were also greatest for "other races" and lowest for African Americans.